Tariff Management with NetSuite: How Businesses Stay Resilient Amid Trade Turbulence

Understanding Tariffs: A Global Business Concern

What is a Tariff?

Tariffs are taxes imposed by governments on goods imported from other countries. While intended to protect domestic industries or generate revenue, tariffs significantly impact businesses across the supply chain. They raise the cost of imported raw materials, components, and finished products, forcing businesses to either absorb the cost or pass it on to customers through higher prices.

Companies that rely heavily on global sourcing face added financial pressures, while exporters may suffer from retaliatory tariffs, making their products more expensive and less competitive abroad. In today’s interconnected global economy, tariffs are no longer isolated financial policies—they’re strategic levers that can reshape entire industries.

Why Tariffs Matter in International Trade

As international trade hit a record $32 trillion in 2024, tariff strategy has become a cornerstone of global business planning. Tariffs can drive shifts in supply chains, sourcing strategies, and pricing models. While they may provide temporary advantages to domestic suppliers by raising the costs of foreign competitors, the broader economic implications can include inflation, supply chain disruptions, and consumer dissatisfaction.

NetSuite emphasizes the importance of real-time scenario planning to mitigate such risks. Tools that provide financial forecasting, cost modeling, and sourcing simulations are essential in today’s volatile trade environment.

How Do Tariffs Work in Real-World Economics?

Types of Tariffs and Their Impacts

Tariffs come in various forms, each affecting businesses differently:

- Ad valorem tariffs: Charged as a percentage of the product's value.

- Specific tariffs: Set as a fixed fee per unit of goods imported.

- Compound tariffs: A combination of both methods.

These tariffs may be broad-based or narrowly targeted—often aimed at sensitive sectors like steel, electronics, or agriculture. Depending on the structure, tariffs can either subtly nudge business decisions or completely reshape them.

Tariffs as a Policy Tool: Protectionism vs. Globalization

Governments use tariffs to influence both domestic and international markets. On one hand, tariffs protect local industries by making imports more expensive. On the other, they can instigate trade disputes that trigger retaliatory tariffs and stifle global cooperation.

In recent years, countries have increasingly used tariffs as leverage not only in trade negotiations but also in broader geopolitical contexts such as national security, border control, and public health. This complexity increases uncertainty, making it essential for businesses to adopt flexible planning tools—like NetSuite’s ERP and continuous scenario modeling features—to stay ahead.

What Do the Tariffs Mean for Canadians?

Tariff Volatility and Canadian Trade Exposure

Canada, as a major trading nation, is particularly sensitive to changes in global tariff policies. Whether the tariffs are directed at or imposed by Canada’s largest trading partners—like the United States or China—the ripple effects are quickly felt across industries from manufacturing to agriculture.

With the US averaging a tariff rate increase from 2.5% to 8.4% in 2025, Canadian companies that export to or import from the US face a double impact: increased costs for inbound goods and reduced competitiveness in outbound markets. This kind of volatility necessitates agile systems like NetSuite, which allows Canadian businesses to model various scenarios and anticipate disruptions before they hit the bottom line.

Impact on Canadian Consumers and Businesses

Tariffs raise consumer prices—often significantly. In 2025, Canadian households saw a projected increase of CAD $1,800–$2,400 in average annual expenses due to new US and Chinese tariffs. For businesses, particularly importers and retailers, the effects are immediate: squeezed margins, disrupted inventory planning, and pricing instability.

NetSuite’s dynamic dashboards and landed cost features are especially useful here, enabling Canadian businesses to calculate the real cost of goods, update pricing models in real time, and protect profitability even under shifting trade rules.

How NetSuite Empowers Continuous Scenario Planning for Tariffs

Real-Time Scenario Modeling

Finance and operations teams can instantly model the impact of new or changing tariffs on landed costs, revenue, and gross profit.

- ✅ Rapid “what-if” analysis shows how tariff changes could affect the bottom line — before any decisions are finalized.

- ✅ Helps simulate alternative sourcing strategies, pricing models, and market adjustments in real time.

Business Impact: Quick, confident decision-making that anticipates changes rather than reacts to them.

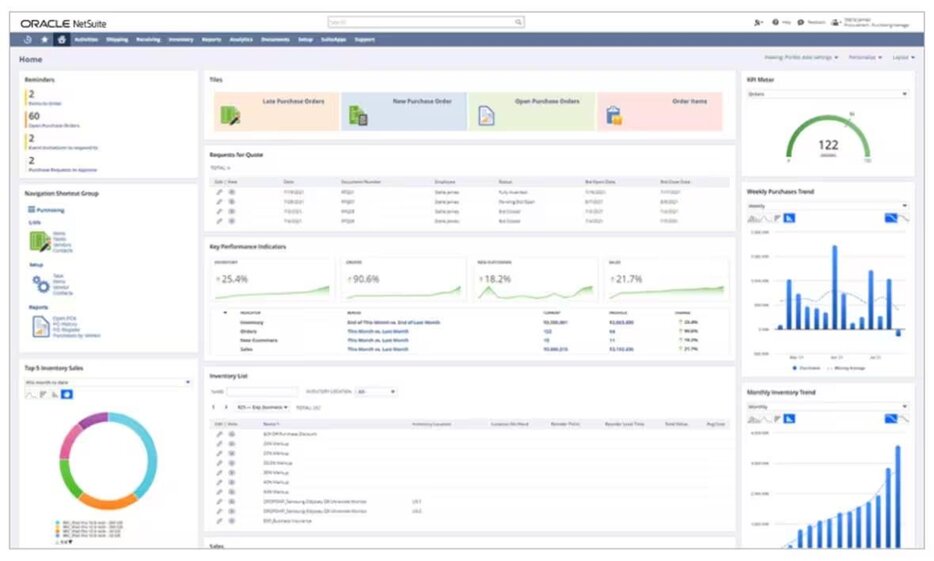

Dynamic Dashboards

Tariffs, supply routes, sourcing strategies—these variables can change overnight.

- ✅ NetSuite’s dynamic dashboards automatically refresh as assumptions shift.

- ✅ Continuous forecasting ensures that pricing, sourcing, and revenue plans stay aligned with the latest trade realities.

Business Impact: Stay one step ahead of regulatory changes, supply chain disruptions, and cost fluctuations.

Cost and Profitability Analysis by SKU, Customer, and Region

Not all products or markets are equally exposed to tariffs. NetSuite provides granular cost breakdowns at the SKU, customer, and regional level.

- ✅ Identify which items or markets are most vulnerable.

- ✅ Prioritize mitigation strategies like supplier diversification, SKU rationalization, or price adjustments.

Business Impact: Protect profits by making precise, targeted moves rather than broad, reactive cuts.

Integration with Excel for Ad Hoc Analysis

Need even deeper custom modeling? NetSuite enables integration with Excel through tools like CloudExtend, empowering teams to:

- ✅ Perform ad hoc scenario analysis

- ✅ Model alternative sourcing paths

- ✅ Track the impact of tariffs on specific SKUs or customer segments

Business Impact: Speed, flexibility, and insights without waiting on IT or manual report generation.

Automated Landed Cost Calculation

NetSuite’s Landed Cost functionality ensures tariffs, duties, freight, customs, and insurance are fully captured and allocated into inventory costs.

- ✅ Achieve accurate landed cost tracking at the item and transaction level.

- ✅ Make pricing and margin decisions based on true total product costs.

Business Impact: No hidden costs. No surprises. Only informed, profitable pricing strategies.

Continuous Monitoring and Updates

Because tariff rates can change quickly, NetSuite supports ongoing updates and reviews of:

- ✅ Tariff rates by product category and country

- ✅ Trade compliance requirements

- ✅ Cost structures affecting supply chains and profitability

Business Impact: Real-time tariff monitoring prevents financial gaps, pricing delays, and non-compliance risks.

Typical Use Cases of NetSuite for Tariff Management

- ✅ Modeling the financial impact of newly imposed tariffs on imported goods

- ✅ Adjusting supplier strategies to offset tariff-driven cost increases

- ✅ Forecasting profitability under multiple tariff scenarios to guide strategic pricing

- ✅ Updating customer contracts and pricelists based on adjusted landed costs

- ✅ Flagging high-risk SKUs and supply routes to proactively address tariff exposure

Minimize the Impacts of Tariffs With NetSuite

Mitigate Risk to Your Supply Chain

NetSuite's supply chain management suite complements its ERP capabilities by helping businesses uncover inefficiencies and offset new costs. Whether it’s analyzing freight consolidations, optimizing warehouse flow, or adjusting supplier allocations, NetSuite helps identify strategies that build long-term resilience.

- ✅ Run profit impact simulations on every import or tariff shift

- ✅ Explore AI-driven suggestions to reroute supply chains

- ✅ Combine cost modeling with operational strategy for end-to-end protection

By pairing automation with strategic planning, NetSuite not only mitigates the immediate impact of tariffs—it future-proofs your business model against tomorrow’s trade disruptions.

Tariff Mitigation Strategies with NetSuite

| Strategy | Description | NetSuite Feature |

|---|---|---|

| SKU Rationalization | Reduce or modify products most impacted by tariffs. | SKU-level cost analysis dashboard |

| Strategic Pricing Adjustments | Raise or recalibrate prices to maintain margins without losing customers. | Real-time landed cost tracking, margin forecasting |

| Cost Sharing with Suppliers | Negotiate contracts where suppliers absorb part of the tariff cost. | Contract and vendor management modules |

| Scenario Planning | Evaluate multiple “what-if” scenarios before making decisions. | Integrated forecasting engine with AI support |

| Inventory Optimization | Stockpile inventory strategically to avoid short-term tariff spikes. | Supply chain visibility and inventory planning tools |

Comprehensive Support Beyond Technology

At Haya Solutions, we don’t just implement NetSuite—we help businesses strategically redesign processes to thrive under changing trade conditions.

Our retail, wholesale, and manufacturing clients rely on us for:

- 🔹 Expert consulting and NetSuite customization

- 🔹 Business process optimization for tariff resilience

- 🔹 Ongoing support and real-time scenario planning enablement

We help you turn tariff disruption into opportunity—with data, speed, and confidence.

The Risks of Ignoring Tariff Management

Organizations that fail to invest in continuous scenario planning and landed cost management expose themselves to:

- 🚫 Inaccurate pricing and margin loss

- 🚫 Unexpected financial shortfalls

- 🚫 Increased regulatory scrutiny and audit risk

- 🚫 Inefficient sourcing and supply chain breakdowns

- 🚫 Distorted reporting leading to poor executive decision-making

In a world where trade rules change overnight, agility is not a luxury — it’s a necessity.

Final Thoughts: Build Tariff Resilience with NetSuite

Smart businesses aren’t just reacting to trade changes — they’re forecasting, modeling, and winning because they are prepared.

With NetSuite’s supply chain and ERP insights and Haya Solutions’ strategic expertise, your business can:

- 🔹 Make faster, smarter decisions

- 🔹 Protect profits and customer relationships

- 🔹 Build a supply chain that thrives through uncertainty

Ready to future-proof your operations?

👉 Connect with a trusted NetSuite Partner Toronto to discuss how Haya Solutions can help you stay agile and competitive in a world of evolving tariffs.